12 Aug 2025 01:20

Podcast #211: Vail Resorts Chairperson & CEO Rob Katz

Who

Rob Katz, Chairperson and Chief Executive Officer, Vail Resorts

Recorded on

August 8, 2025

About Vail Resorts

Vail Resorts owns and operates 42 ski areas in North America, Australia, and Europe. In order of acquisition:

The company’s Epic Pass delivers skiers unlimited access to all of these ski areas, plus access to a couple dozen partner resorts:

Why I interviewed him

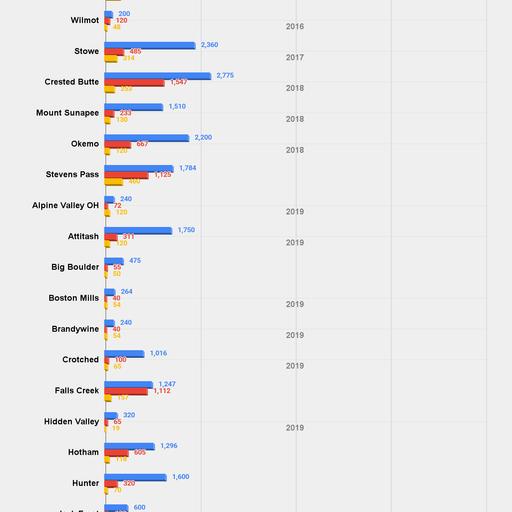

How long do you suppose Vail Resorts has been the largest ski area operator by number of resorts? From how the Brobots prattle on about the place, you’d think since around the same time the Mayflower bumped into Plymouth Rock. But the answer is 2018, when Vail surged to 18 ski areas – one more than number two Peak Resorts. Vail wasn’t even a top-five operator until 2007, when the company’s five resorts landed it in fifth place behind Powdr’s eight and 11 each for Peak, Boyne, and Intrawest. Check out the year-by-year resort operator rankings since 2000:

Kind of amazing, right? For decades, Vail, like Aspen, was the owner of some great Colorado ski areas and nothing more. There was no reason to assume it would ever be anything else. Any ski company that tried to get too big collapsed or surrendered. Intrawest inflated like a balloon then blew up like a pinata, ejecting trophies like Mammoth, Copper, and Whistler before straggling into the Alterra refugee camp with a half dozen survivors. American Skiing Company (ASC) united eight resorts in 1996 and was 11 by the next year and was dead by 2007. Even mighty Aspen, perhaps the brand most closely associated with skiing in American popular culture, had abandoned a nearly-two-decade experiment in owning ski areas outside of Pitkin County when it sold Blackcomb and Fortress Mountains in 1986 and Breckenridge the following year.

But here we are, with Vail Resorts, improbably but indisputably the largest operator in skiing. How did Vail do this when so many other operators had a decades-long head start? And failed to achieve sustainability with so many of the same puzzle pieces? Intrawest had Whistler. ASC owned Heavenly. Booth Creek, a nine-resort upstart launched in 1996 by former Vail owner George Gillett, had Northstar. The obvious answer is the 2008 advent of the Epic Pass, which transformed the big-mountain season pass from an expensive single-mountain product that almost no one actually needed to a cheapo multi-mountain passport that almost anyone could afford. It wasn’t a new idea, necessarily, but the bargain-skiing concept had never been attached to a mountain so regal as Vail, with its sprawling terrain and amazing high-speed lift fleet and Colorado mystique. A multimountain pass had never come with so little fine print – it really was unlimited, at all these great mountains, all the time - but so many asterisks: better buy now, because pretty soon skiing Christmas week is going to cost more than your car. And Vail was the first operator to understand, at scale, that almost everyone who skis at Vail or Beaver Creek or Breckenridge skied somewhere else first, and that the best way to recruit these travelers to your mountain rather than Deer Valley or Steamboat or Telluride was to make the competition inconvenient by bundling the speedbump down the street with the Alpine fantasy across the country.

Vail Resorts, of course, didn’t do anything. Rob Katz did these things. And yes, there was a great and capable team around him. But it’s hard to ignore the fact that all of these amazing things started happening shortly after Katz’s 2006 CEO appointment and stopped happening around the time of his 2021 exit. Vail’s stock price: from $33.04 on Feb. 28, 2006 to $354.76 to Nov. 1, 2021. Epic Pass sales: from zero to 2.1 million. Owned resort portfolio: from five in three states to 37 in 15 states and three countries. Epic Pass portfolio: from zero ski areas to 61. The company’s North American skier visits: from 6.3 million for the 2005-06 ski season to 14.9 million i