28 Jan 2026 03:19

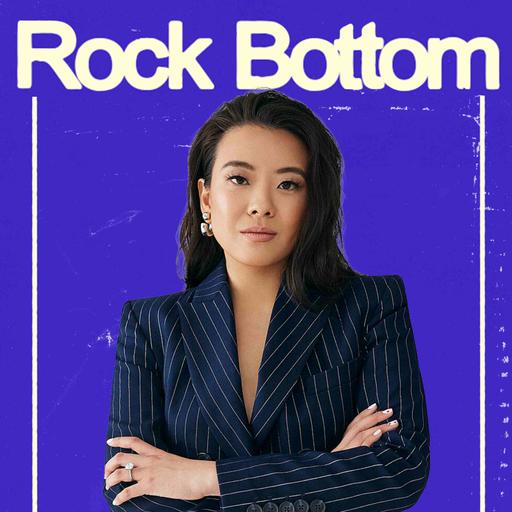

Why Prenups Matter & Financial Rock Bottoms | Your Rich BFF Vivian Tu

Financial educator and bestselling author Vivian Tu (Your Rich BFF) sits down with Ned to share the devastating rock bottom moment that changed everything: discovering her New York City apartment was infested with thousands of German cockroaches. Breaking her lease cost $8,000—wiping out every dollar she'd saved from her grueling 70-80 hour weeks as an equity trader on Wall Street. After a year and a half of work, she had less money than when she'd arrived in the city. This financial catastrophe came on the heels of workplace harassment from a new manager who made racist comments and belittled her daily, ultimately pushing her to leave Wall Street entirely for a career pivot to BuzzFeed. What seemed like total failure became the launching pad for building one of the most influential personal finance platforms in the world, with millions of followers learning accessible money management from someone who truly understands struggle. Vivian breaks down why financial literacy education has failed so many people—it's not the message that's wrong, it's the messenger. For decades, money advice has come from "tall, handsome white men in Patagonia vests" or judgmental figures who treat debt as moral failure. She offers a radically different approach: practical, shame-free guidance that recognizes money as a tool, not a measure of your worth as a human being. This episode covers essential money topics everyone needs to hear: why prenups are actually romantic (the government writes one for you whether you like it or not), the "Is It Worth It?" equation that helps you understand purchases in terms of hours worked instead of dollars, why budgeting actually increases joy rather than restricting it, and the uncomfortable financial conversations couples must have at every stage—from the first date through marriage, kids, aging parents, and estate planning. Vivian also tackles the myth that small luxuries like lattes are keeping people poor (spoiler: $1,800 a year won't buy you a house), explains why 50% of Americans have credit card debt and shouldn't feel ashamed, and shares why asking for help from actual humans—not corporations and apps—is the missing ingredient in both financial health and mental wellbeing. Her new book Well Endowed hits shelves February 3rd and offers a comprehensive guide to building a life where your finances support your actual goals and values—not someone else's definition of success.